3 Reasons Affordability Is Showing Signs of Improvement This Fall

3 Reasons Affordability Is Showing Signs of Improvement This Fall

For the past couple of years, it’s been tough for a lot of homebuyers to make the numbers work. Home prices shot up. Mortgage rates too. And a number of people hit pause because it just didn’t feel possible. Maybe you were one of them.

But there’s some encouraging news. If you’ve been waiting for a better time to jump back in, affordability may finally be showing signs of improvement this fall.

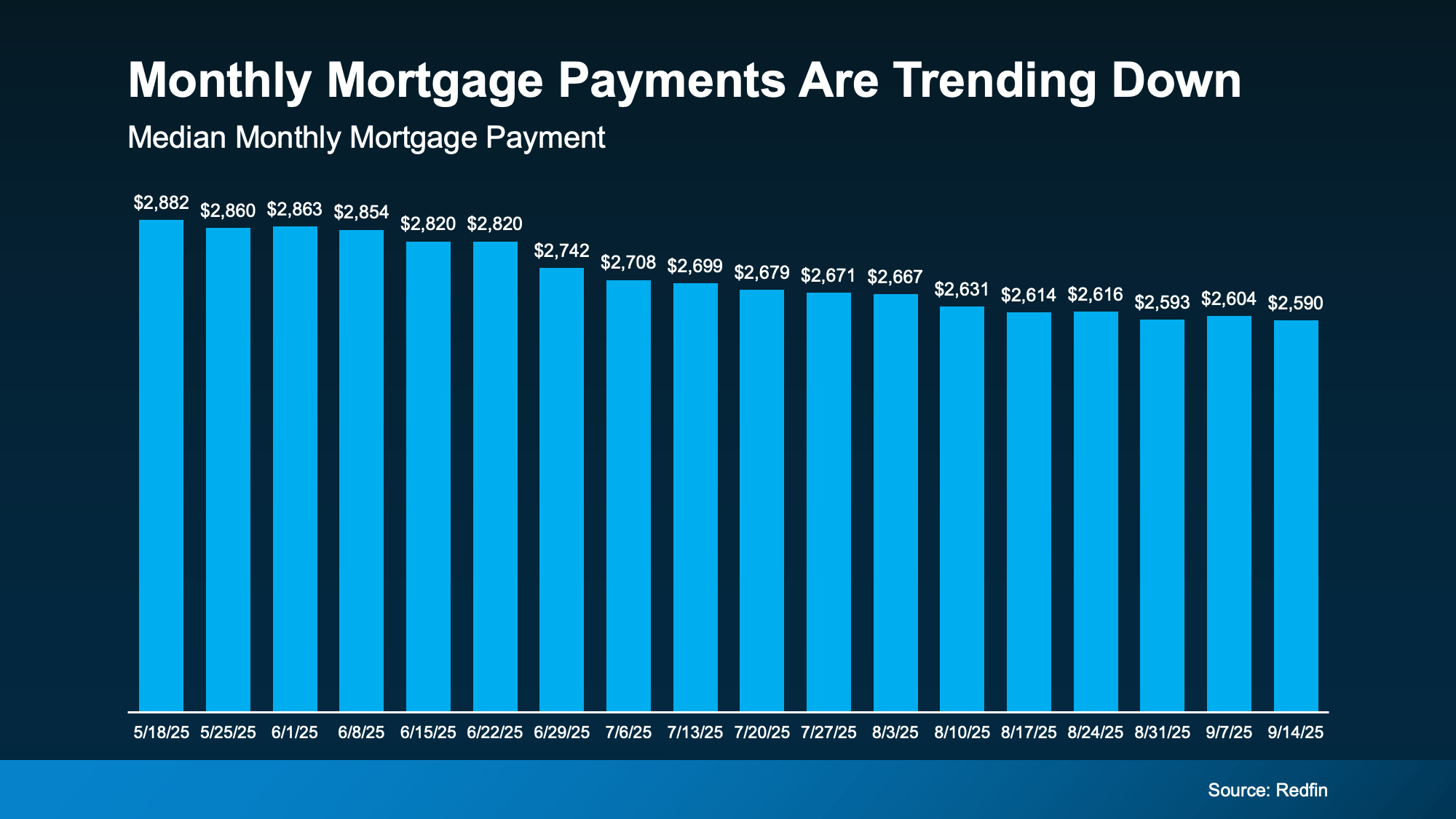

The latest data from Redfin shows the typical monthly mortgage payment has been coming down, and is now about $290 lower than it was just a few months ago (see graph below):

And here’s why this is happening. The cost of buying a home really comes down to three things:

And here’s why this is happening. The cost of buying a home really comes down to three things:

- Mortgage rates

- Home prices

- Your wages

Right now, all three are finally moving in a better direction for you. While that doesn’t mean it’s suddenly easy to buy at today’s rates and prices, it does mean it’s not as challenging.

1. Mortgage Rates

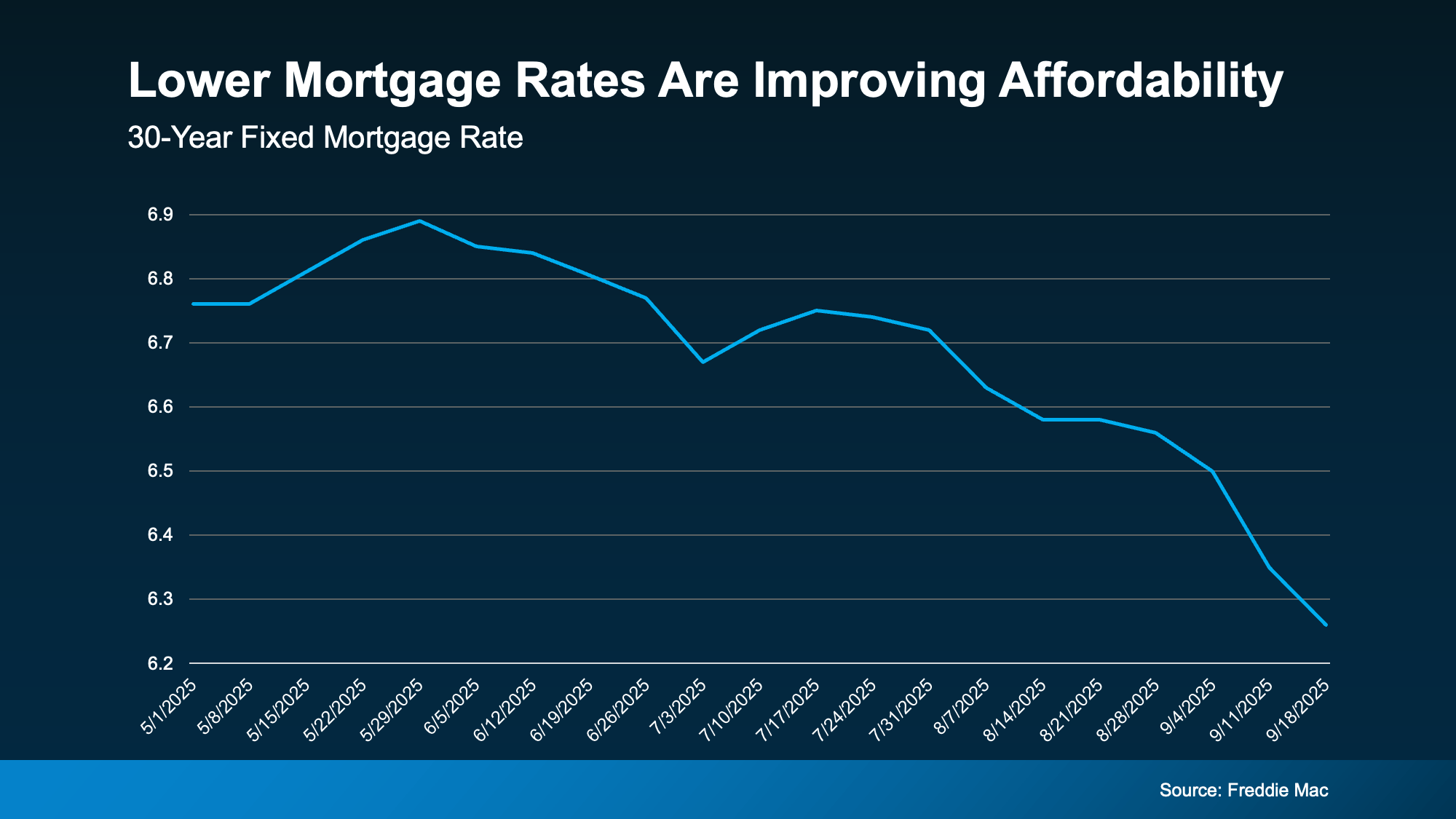

Mortgage rates have come down compared to earlier this year. In May, they were roughly 7%. And now, they’re closer to 6.3% (see graph below):

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment. Compared to when rates were 7%, if you take out an average $400K mortgage now at 6.3%, it’ll cost about $190 less a month based on just rates alone.

That may not sound like a big deal, but it does matter. Even small changes in rates can make a difference in your future monthly payment. Compared to when rates were 7%, if you take out an average $400K mortgage now at 6.3%, it’ll cost about $190 less a month based on just rates alone.

And for some people, that’s been enough to make buying a home possible again. As Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explained on September 10th:

“The downward rate movement spurred the strongest week of borrower demand since 2022 . . . Purchase applications increased to the highest level since July and continued to run more than 20 percent ahead of last year’s pace.”

2. Home Prices

After several years of prices rising very rapidly, price growth has finally slowed. As Odeta Kushi, Deputy Chief Economist at First American, puts it:

“National home price growth remains positive, but muted — low single digits — and we expect this trend to continue in the second half of the year.”

For buyers, that’s actually a big relief. That moderation makes it easier to plan your budget. And in some markets, prices have even dipped slightly. If you're in one of the markets, you may be able to find something that’s more affordable than you'd expect.

3. Wages

According to the Bureau of Labor Statistics (BLS), wages are up near 4% annually. Lawrence Yun, Chief Economist at NAR, explains why that number is so important right now:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

In other words, the typical paycheck is rising faster than home prices right now, which helps make buying a little more affordable. Now, it’s not a big difference, but in a market like this, every bit counts.

What This Means for You

Lower rates, slower price growth, and stronger wages might be enough to make the numbers finally work for you this fall.

While affordability is still tight, it’s a little easier on your wallet to buy now than it was just few months ago. Remember, data from Redfin shows the typical monthly mortgage payment is already around $290 lower than it was earlier this year.

Thinking of buying a home? Affordability is improving this fall. Discover 3 key reasons why now might be the right time to make your move.

- Fall 2025 housing market

- Home affordability trends

- Is it a good time to buy a house

- Mortgage rates fall 2025

- Reasons to buy a home now

- Housing market predictions

- Improving home affordability

- First-time home buyer fall 2025

- Real estate market analysis

- Lower home prices

- Housing affordability index

- Autumn home buying season

- Benefits of buying a house in the fall

- Current mortgage interest rates

- Housing inventory update

As we look at the housing market this autumn, several key data points suggest a positive shift for potential buyers. Recent analysis from the National Association of Realtors shows a slight easing in market competition, which could signal more opportunities. Financial experts at publications like The Wall Street Journal are noting subtle changes in economic indicators that favor homebuyers, while the latest Consumer Price Index report from the Bureau of Labor Statistics points to moderating inflation, which may influence future mortgage rates. For a deeper dive into current mortgage trends, resources from Freddie Mac and Fannie Mae offer comprehensive weekly updates. Furthermore, insights from Zillow Research and Redfin's market analysis highlight shifts in inventory and pricing. To understand the broader economic context, you can review projections from the Federal Reserve. Homebuilders are also responding, with the latest U.S. Census Bureau data on housing starts indicating a potential increase in supply. Finally, financial planning resources like NerdWallet provide valuable tools for prospective buyers to assess their readiness in this evolving market.

Bottom Line

Have you been wondering if it’s worth taking another look at buying?

Let’s run the numbers together. We can go over your budget, see what’s changed, and figure out if this fall is the time to turn window-shopping into key-turning.

Categories

Recent Posts