5 Keys To Hitting Your Homeownership Goals in 2024

5 Keys To Hitting Your Homeownership Goals in 2024

Homeownership is a significant part of the proverbial "American Dream," offering not just a roof over your head but a sense of stability, security, and independence. If you've set your sights on owning a home by the year 2024, there are three vital keys to help you reach this goal.

1. Start Saving Early

The journey to homeownership starts with saving. With most home purchases requiring a down payment—typically ranging from 3% to 20% of the home's purchase price—it's crucial to start saving as early as possible. Establish a realistic saving plan and stick to it. Consider setting aside a specific portion of your income every month towards your down payment fund.

2. Improve Your Credit Score

A high credit score is your ticket to better interest rates on your mortgage. Be diligent about making payments on time, keep your credit utilization low, and try to pay off existing debts. Regularly check your credit report to ensure there are no errors that could negatively impact your score.

3. Research the Housing Market

Understanding the housing market in your desired location will be crucial to your homeownership goals. Pay attention to market trends, property values, and the local economy. Use this information to decide when it's the best time to buy.

By focusing on these three keys—starting to save early, improving your credit score, and researching the housing market—you'll be well on your way to unlocking the door to your dream home in 2024. Remember, homeownership is a journey, not a race. Take your time, make informed decisions, and look forward to the day you hold the keys to your own home.

4. Understand the Importance of Home Inspections

Before you finalize your home purchase in 2024, it's essential to understand the value of a comprehensive home inspection. A home inspection can reveal potential issues that could become costly repairs in the future. With this knowledge, you can negotiate for repairs or a better price. Key areas to inspect include the home's foundation, roof, plumbing, and electrical systems.

In this journey towards homeownership, remember the mantra - Save, Score, Research, and Inspect. By implementing these strategies, you are not just buying a house; you are investing in your future. Let 2024 be the year you achieve your homeownership goals.

Keywords: Homeownership 2024, start saving early, improve credit score, housing market research, home inspection importance, investing in future.

5. The Benefits of Homeownership

Homeownership is more than just a roof over your head. It's an investment that comes with numerous benefits, both tangible and intangible. Financially, owning a home can lead to building wealth over time as property values typically increase and home equity grows. It offers potential tax benefits, as mortgage interest and property taxes are often tax-deductible. Moreover, it gives homeowners the freedom to make decisions about their property, including renovations and modifications that can further increase its value.

In addition to financial advantages, homeownership brings about a sense of stability and security. Knowing you have a place that you can truly call your offers emotional satisfaction and adds to your sense of well-being. It provides a space to create lifelong memories and fosters a sense of community connection. In essence, homeownership can contribute to overall life satisfaction, making it a worthy goal for many.

Keywords: Benefits of homeownership, financial growth, tax benefits, freedom, stability, emotional satisfaction, community connection, life satisfaction.

Categories

Recent Posts

The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Is the Housing Market Going To Crash? Here’s What Experts Say

Quick Tip of the Day: Meet with a Staging Consultant Before Listing Photos!

The $280 Shift in Affordability Every Homebuyer Should Know

2026 Housing Market Outlook

Quick Tip of the Day: You Have Time to Back Out—Here’s What Buyers Should Know

Why More Buyers Are Turning to New Construction This Year

Quick Tip of the Day: Aim for Positive Cash Flow from Day One

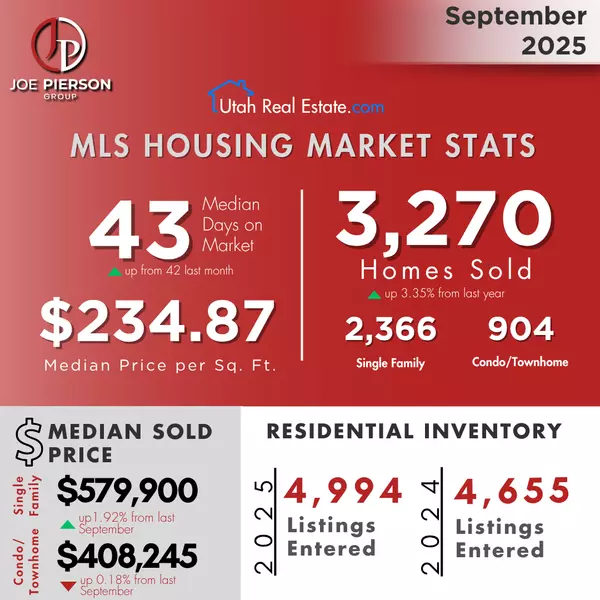

September 2025 Market Overview

Don’t Let Unrealistic Pricing Cost You Your Move