Bridging the Gaps on the Road to Homeownership

Bridging the Gaps on the Road to Homeownership

Homeownership is a major part of the American Dream. But, the path to achieving this dream can be quite difficult. While progress has been made to improve fair housing access, households of color still face unique challenges on the road to owning a home. Working with the right real estate experts can make all the difference for diverse buyers.

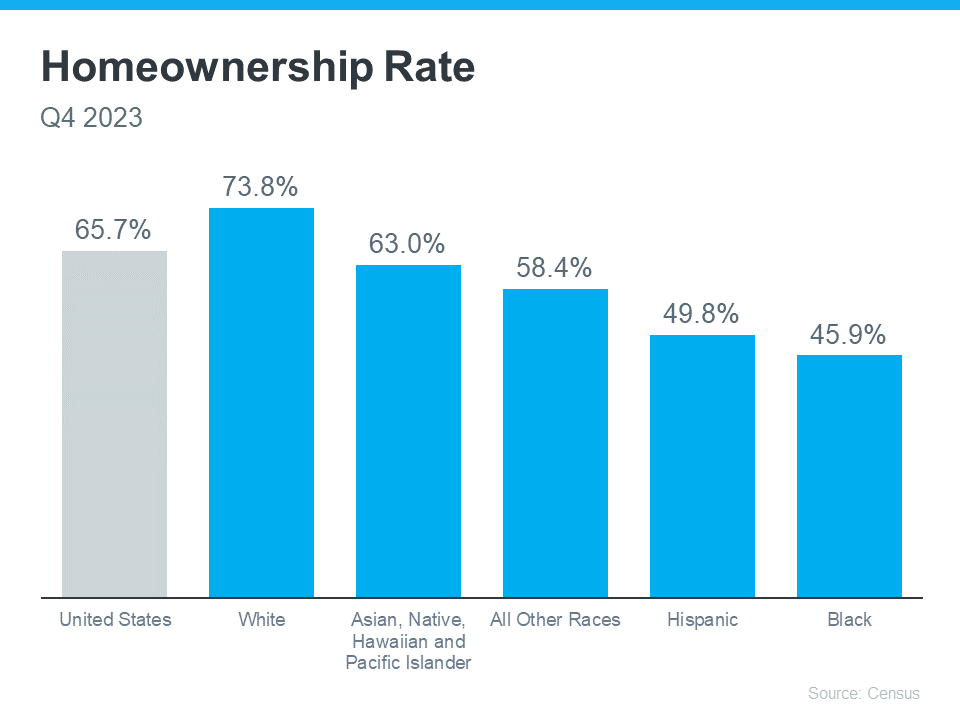

It's clear that achieving homeownership is more challenging for certain groups because there’s still a measurable gap between the overall average U.S. homeownership rate and that of non-white groups. Today, Black households continue to have the lowest homeownership rate nationally (see graph below):

Homeownership is an important part of building household wealth that can be passed down to future generations. According to a report by the National Association of Realtors (NAR), almost half of Black homebuyers in 2023 were first-time buyers. That means many didn’t have home equity they could use toward their home purchase.

That financial hurdle alone makes buying a home more challenging, especially at a time when affordability is a major concern for first-time buyers. Jessica Lautz, Deputy Chief Economist at NAR says:

“It’s an incredibly difficult market for all home buyers right now, especially first-time home buyers and especially first-time home buyers of color.”

Because of these challenges, there are several down payment assistance programs specifically aimed at helping minority buyers fulfill their homeownership dreams:

- The 3By30 program offers valuable resources for Black buyers, making it easier for them to secure a down payment and buy a home.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that make homeownership more attainable by providing support with down payments and other costs.

- Fannie Mae provides down payment assistance to eligible first-time homebuyers living in Latino communities.

Even if you don’t qualify for these programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that best meet your needs.

For minority homebuyers, the challenges that remain can be a point of pain and frustration. That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals aren’t only experienced advisors who understand the market and give the best advice, they’re also compassionate educators who will advocate for your best interests every step of the way.

Bottom Line

Let’s connect to make sure you have the information and support you need as you walk the path to homeownership.

Keywords:

- Homeownership process

- First-time home buyer tips

- Home buying guide

- Real estate investment strategies

- Mortgage application advice

- Down payment assistance

- Credit score improvement for home buying

- Property market trends

- Closing cost planning

- Homeownership barriers

Meta Description:

Discover essential insights for navigating the complex journey to homeownership. Our comprehensive guide offers tips for first-time buyers, strategies for real estate investment, advice on mortgage applications, and ways to overcome common barriers. Delve into the latest property market trends, down payment assistance, and learn how to improve your credit score for a smoother home buying experience.

Backlinks:

- National Association of Realtors - Gain expert knowledge on real estate trends and statistics.

- Consumer Financial Protection Bureau - Home Buying - Access resources and tools to help make informed home buying decisions.

- HUD.gov - Homeownership - Understand government programs and assistance for homeowners.

- Freddie Mac's CreditSmart - Learn how to manage your credit effectively on your path to homeownership.

- Down Payment Resource Center - Find available down payment assistance programs in your area.

Categories

Recent Posts