Buying Your First Home? FHA Loans Can Help

Buying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan.

They’re designed to help you overcome some of the biggest financial hurdles in the homebuying process – and that’s why so many first-timers are using them to make their purchase.

Whether you’re dreaming of ditching rent, planting roots, or just wanting a place that’s truly yours, an FHA home loan could be the path that gets you there sooner than you think.

Buying Your First Home Probably Doesn’t Feel Easy Right Now

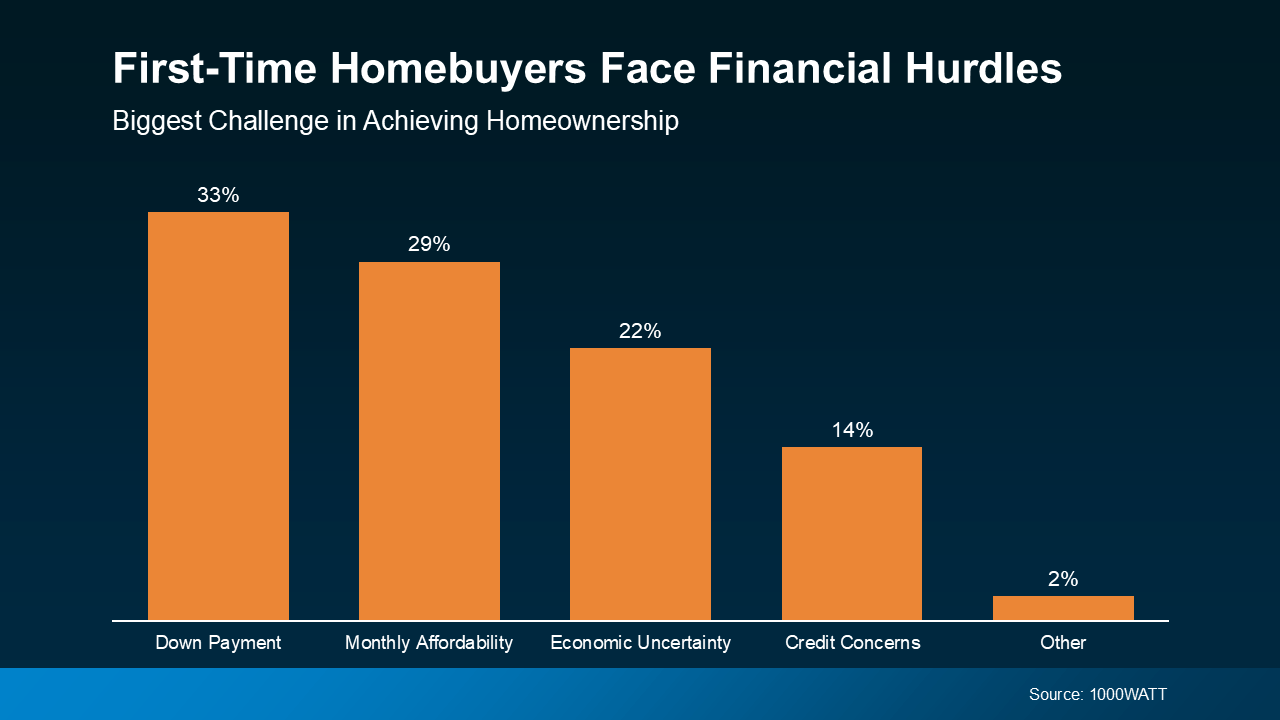

While the motivation to buy a home is still there for many people, affordability is a real challenge today. According to a survey from 1000WATT, potential first-time buyers say their top two concerns are saving enough for their down payment and making the monthly mortgage payments work at today’s home prices and mortgage rates (see graph below):

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In

FHA loans help many first-time buyers overcome these challenges.

In fact, according to Intercontinental Exchange (ICE), the average first-time buyer using an FHA loan puts down just $16,000. That’s a big difference from the $77,000 they’re putting down with the typical conventional mortgage (see graph below):

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

That’s because, a lot of the time, the mortgage rate on FHA loans can be lower. Bankrate says:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

So, if you’re thinking about buying your first place, an FHA loan may be worth exploring.

Because of the potential for lower down payment requirements and maybe even a lower mortgage rate, it could help with the two most common hurdles first-time buyers face today – saving enough money upfront and affording the monthly payment.

A trusted lender can walk you through the details, compare your options, and help you figure out what loan type makes the most sense for your situation.

Discover how FHA loans can make buying your first home easier with flexible requirements and lower down payments. Learn everything you need to know about FHA loans today!

FHA loans, first-time homebuyer, buying a house, home loans, mortgage, affordable housing, real estate, first home, FHA benefits, home financing

Learn more:

If you're buying your first home, FHA loans can be a great resource. With flexible credit requirements, low down payments, and government backing, they make homeownership more accessible. Whether you're learning about mortgage options or exploring first-time homebuyer programs, FHA loans simplify the process. You can also find helpful tools like mortgage calculators or guidance on real estate basics to assist in your search. With an FHA loan, achieving the dream of owning your first home is closer than you think. Find more information through official resources or consult with a trusted lender.

Bottom Line

With the right loan and the right guidance, homeownership may be more achievable than you think.

Do you want to talk more about your options? A trusted lender is there to help.

Categories

Recent Posts