Don’t Let Student Loans Hold You Back from Homeownership

Don’t Let Student Loans Hold You Back from Homeownership

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you're wondering:

- Do you have to wait until you’ve paid off those loans before you can buy your first home?

- Or is it possible you could still qualify for a home loan even with that debt?

Having questions like these is normal, especially when you’re thinking about making such a big purchase. But you should know, you may be putting your homeownership goals on the backburner unnecessarily.

Can You Qualify for a Home Loan if You Have Student Loans?

In the simplest sense, what you want to know is can you still buy your first home if you have student debt. Here’s what Yahoo Finance says:

" . . . student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible."

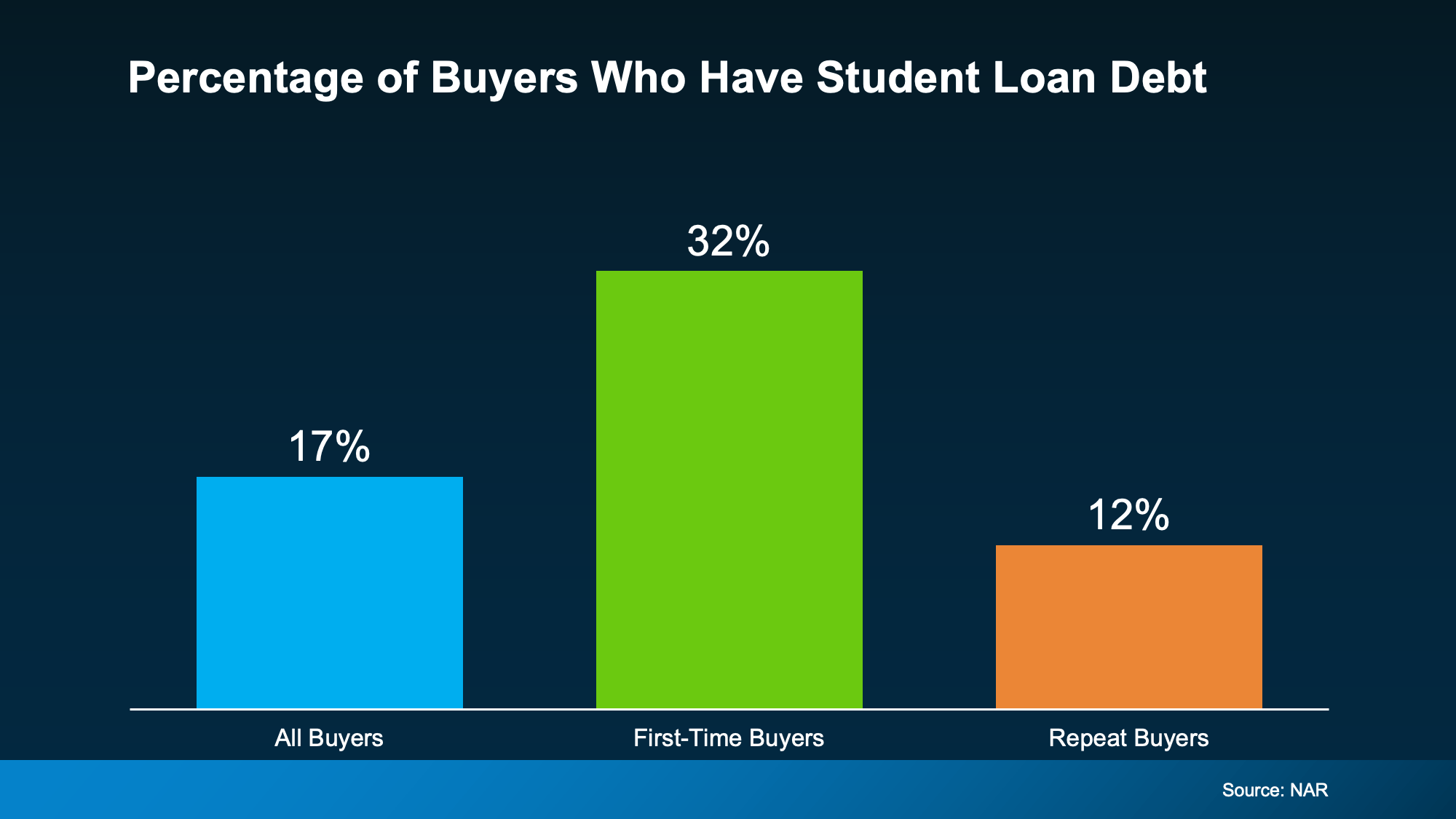

And the data backs this up. An annual report from the National Association of Realtors (NAR), shows that 32% of first-time buyers had student loan debt (see graph below):

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

“It’s important to note that student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

If your income is steady and your overall finances are solid, homeownership can still be within reach. So, having student loans doesn’t necessarily mean you have to wait to buy a home.

Don't let student loans stop you from achieving homeownership. Discover tips on balancing finances and planning ahead for your dream home.

student loans, homeownership, financial planning, first-time homebuyer, debt management, mortgage, homeownership tips, buying a home, saving for a home, financial stability

Learn more:

Student loan debt is a major concern for young adults who dream of owning a home. However, with proper financial planning and budgeting, becoming a homeowner is achievable. Start by understanding your student loan repayment options and how they affect your credit score. Look into potential down payment assistance programs and learn from free homebuyer education courses. Partnering with a knowledgeable real estate agent can help you find the right home within your budget. Explore manageable mortgage options tailored for first-time buyers. Consult with a financial advisor to help balance debt and savings. Lastly, consider joining forums like Reddit’s personal finance community for tips and shared experiences in navigating this major milestone.

Bottom Line

Having student loans doesn’t mean buying a home is off the table. Before you count yourself out, talk to a lender to get a clearer picture of what you can afford and how close you are to taking the first step toward homeownership.

Categories

Recent Posts