Is Wall Street Really Buying All the Homes?

Is Wall Street Really Buying All the Homes?

Let’s be real – buying a home right now is tough. You’re scrolling through listings, rushing to open houses, and maybe even losing out to more competitive offers. Somewhere along the way, you might’ve heard the reason it’s so hard to find a home is because big Wall Street investors are swooping in and snatching up everything in sight.

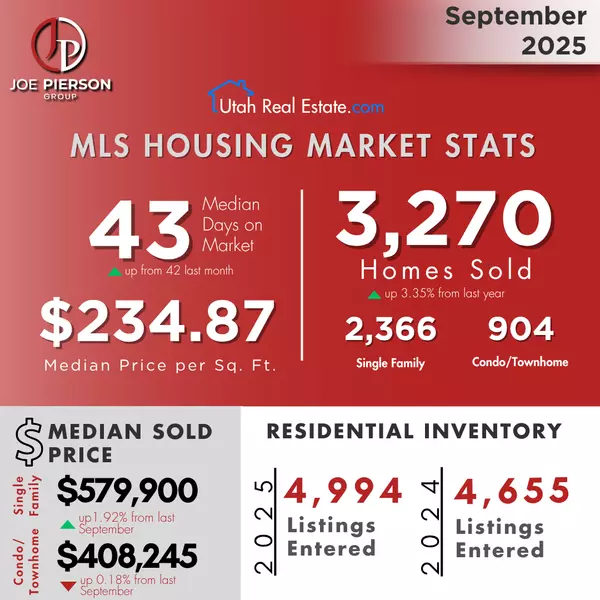

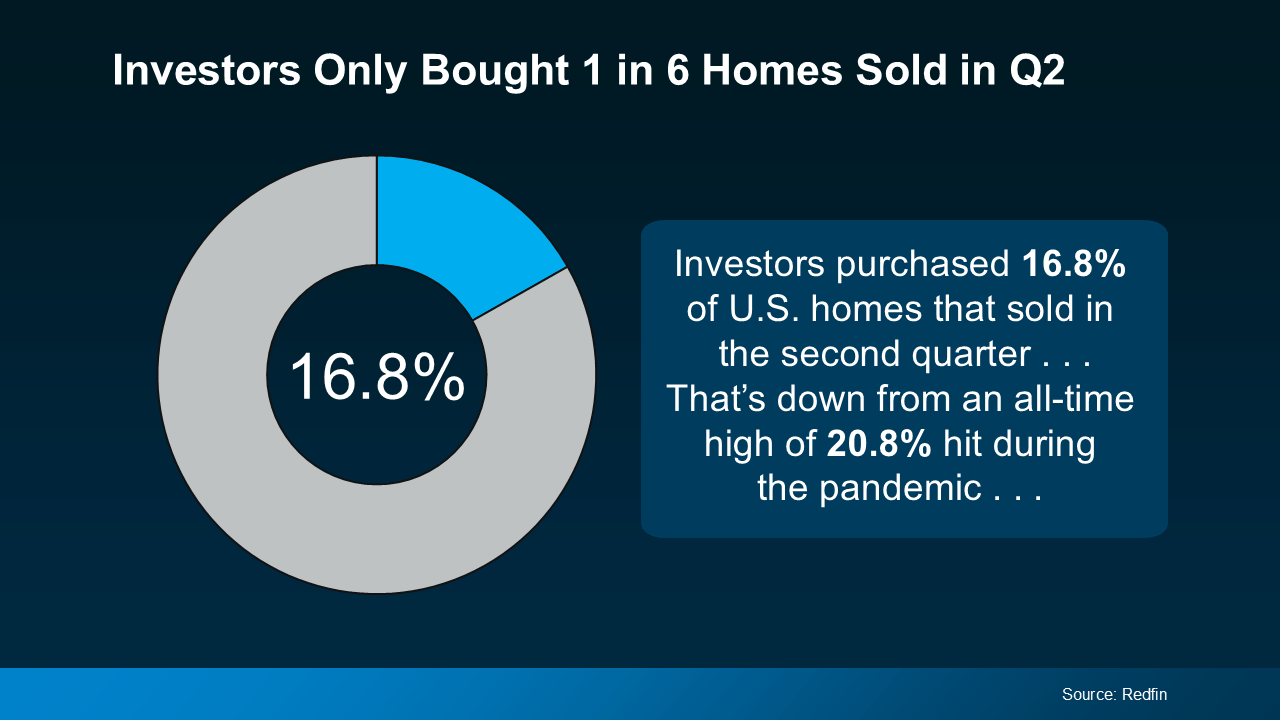

But here’s the thing: that’s mostly a myth. While investors are part of the market, according to Redfin, they’re a relatively small part:

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

Here’s what that means. Five out of every six homes are being purchased by everyday homebuyers like you – not big investors.

So, before you get discouraged, let’s take a look at what’s really going on. You might be surprised to learn that Wall Street isn’t the competition you may think it is.

Most Investors Are Small Mom-and-Pops

Most investors aren’t the mega corporations you’ve probably heard about. In fact, many are your neighbors. A recent report from CoreLogic shows most investors are small, mom-and-pop types who own fewer than 10 properties. They aren’t massive companies with endless resources. Picture your neighbor who has another home they’re renting out or a vacation getaway.

Only about 1% of the market is owned by large, mega investors with thousands of properties. The majority are still owned by individuals and smaller investors – not the Wall Street giants.

Investor Purchases Are Declining

Not only are most investors small, but overall investor purchases have been on the decline. As the same report from CoreLogic says:

“Investors made 80,000 purchases in June 2024, compared with 112,000 in June 2023, and a nearly 50% percent drop from the high of 149,000 purchases in June 2021 . . .”

And what does this mean going forward? CoreLogic goes on to point out this downward trend is expected to continue into 2025.

So, if it seems like competition with investors is pushing you out of the market, it might help to know that investor activity is actually slowing down.

Explore the reality behind claims that Wall Street is buying up all the homes. Learn about the impact of institutional investment on the housing market, homebuyers, and renters.

- Wall Street housing

- Institutional investors real estate

- Home buying trends

- Housing market analysis

- Real estate investment

- Corporate landlords

- Property acquisition

- Housing market impact

- Residential real estate

- Investment homes

Learn more:

- The New York Times - Wall Street's Rental Empire

Bottom Line

The idea that Wall Street is buying up all the homes is largely a myth. Most investors are small ones, and the share of homes purchased by investors is declining – so you can take this one off your worry list.

If you have questions about the housing market, let’s talk.

Categories

Recent Posts