Many Veterans Don’t Know About This VA Home Loan Benefit

Many Veterans Don’t Know About This VA Home Loan Benefit

For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. But even though a lot of Veterans have access to this powerful program, the majority don't know about one of its core benefits.

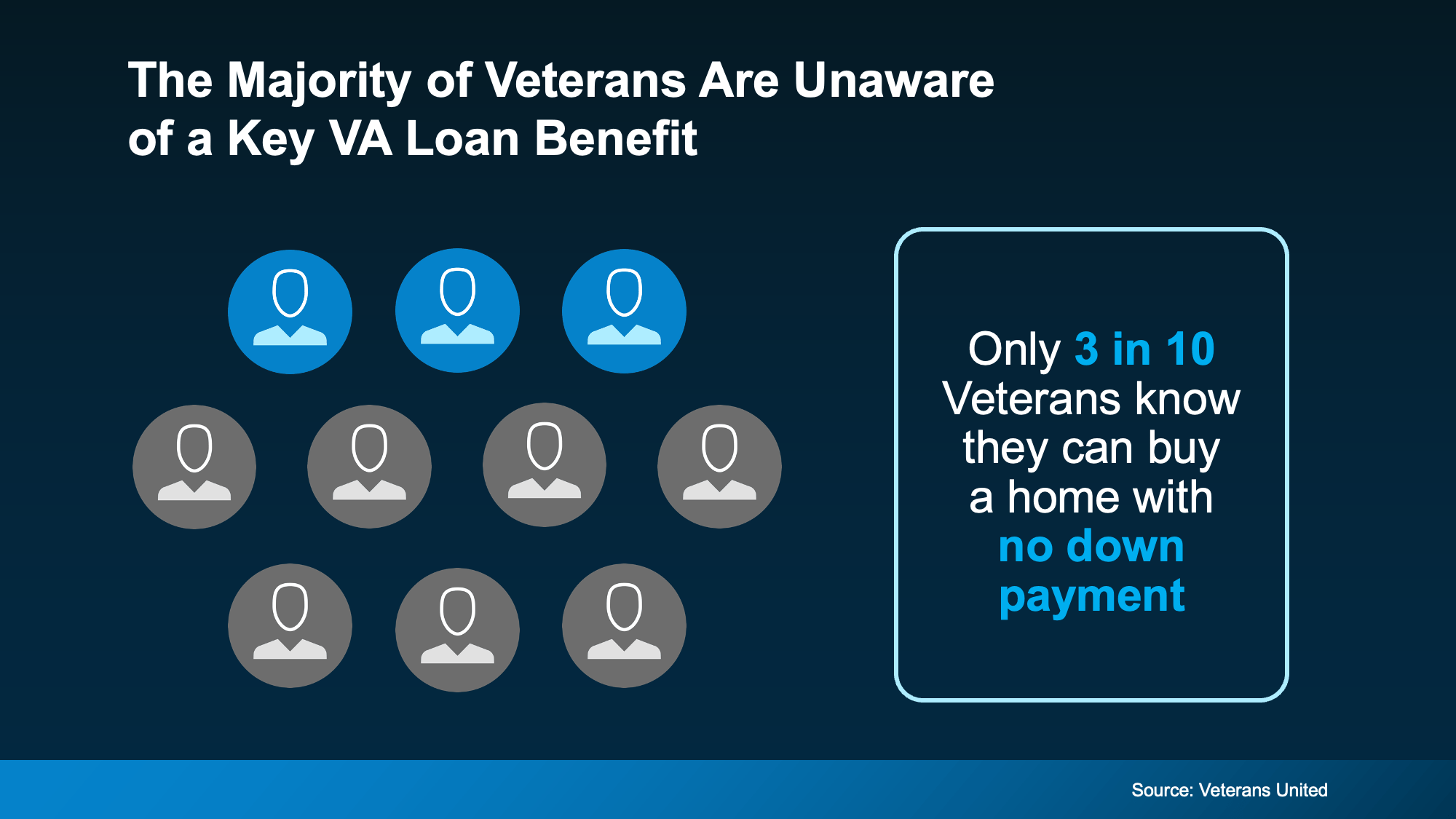

According to a report from Veterans United only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below):

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That’s why it’s so important for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry's lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also give their families the opportunity to plant roots and build equity in a home of their own. Here are some of the biggest advantages for this type of loan according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to big savings over time.

If you want to learn more, your best resource for all the options and advantages of VA loans is your team of expert real estate professionals, including a local agent and a trusted lender.

Discover the VA home loan benefit that many veterans are unaware of. Learn how this program offers affordable homeownership opportunities with low-interest rates and no down payment requirements.

VA home loan benefit, veterans homeownership, VA loan, no down payment, low-interest VA loans, home loans for veterans, VA mortgage program, veteran housing benefits, affordable VA loans, veteran home buying.

Learn more:

Many veterans don’t fully utilize the incredible advantages offered by the VA home loan program, a benefit designed to help veterans achieve homeownership. With no down payment requirements, low-interest rates, and flexible credit standards, this loan program is a perfect fit for those who have served. Veterans can explore eligibility requirements and start the process through the official VA website. Many organizations, such as Military Benefits and Veterans United, provide guidance for veterans to better understand these benefits. Even better, the program often includes refinancing options to make owning or maintaining a home more affordable. By leveraging resources like the Consumer Financial Protection Bureau or local Veteran Service Offices, qualified veterans can maximize this valuable benefit. Don’t overlook opportunities outlined by groups like VA Mortgage Center or take advantage of VA-backed loans. With an array of resources and tools available, veterans can confidently move forward with their dream of homeownership.

Bottom Line

VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan.

Do you know if you’re eligible for a VA home loan? Talk to a trusted lender who can help you see if you’d qualify.

Categories

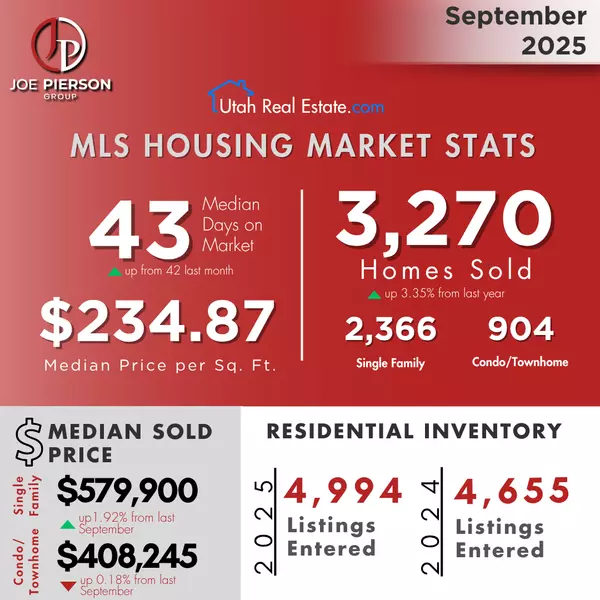

Recent Posts