Stocks May Be Volatile, but Home Values Aren’t

Stocks May Be Volatile, but Home Values Aren’t

With all the uncertainty in the economy, the stock market has been bouncing around more than usual. And if you’ve been watching your 401(k) or investments lately, chances are you’ve felt that pit in your stomach. One day it’s up. The next day, it’s not. And that may make you feel a little worried about your finances.

But here’s the thing you need to remember if you’re a homeowner. According to Investopedia:

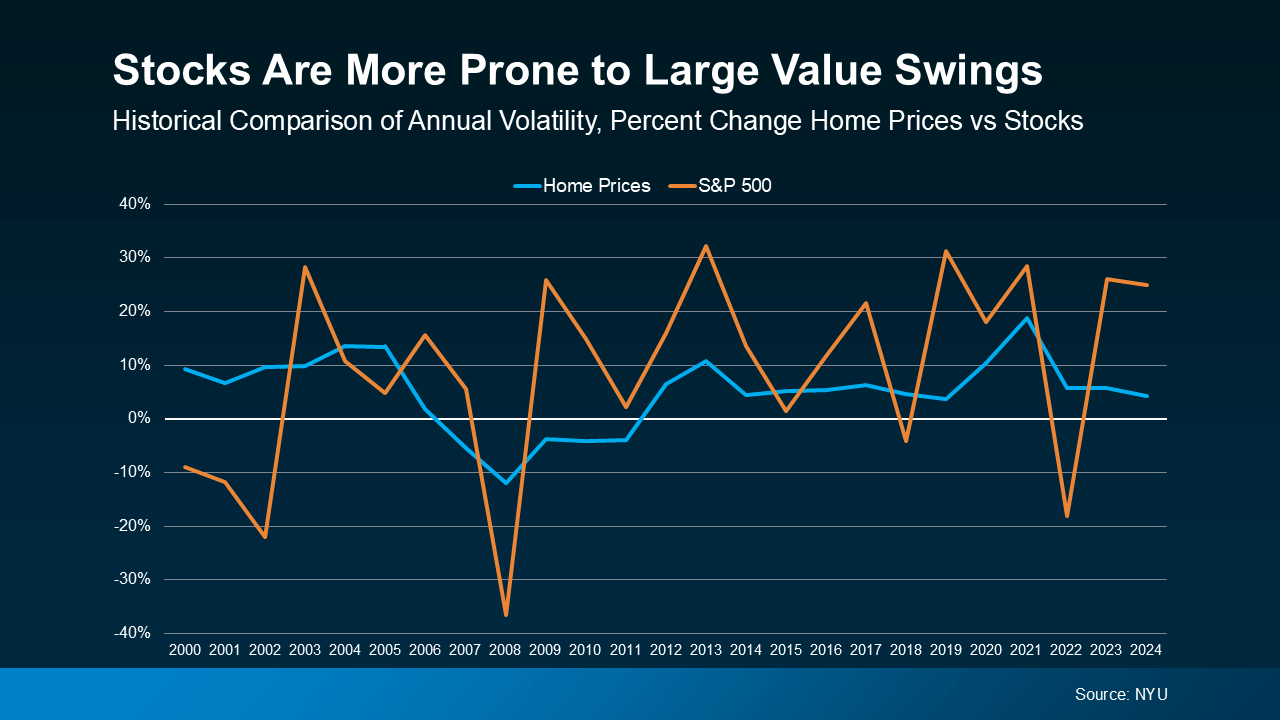

“Traditionally, stocks have been far more volatile than real estate. That's not to say that real estate prices aren't ever volatile—the years around the 2007 to 2008 financial crisis are just one memorable example—but stocks are more prone to large value swings.”

While your stocks or 401(k) might see a lot of highs and lows, home values are much less volatile.

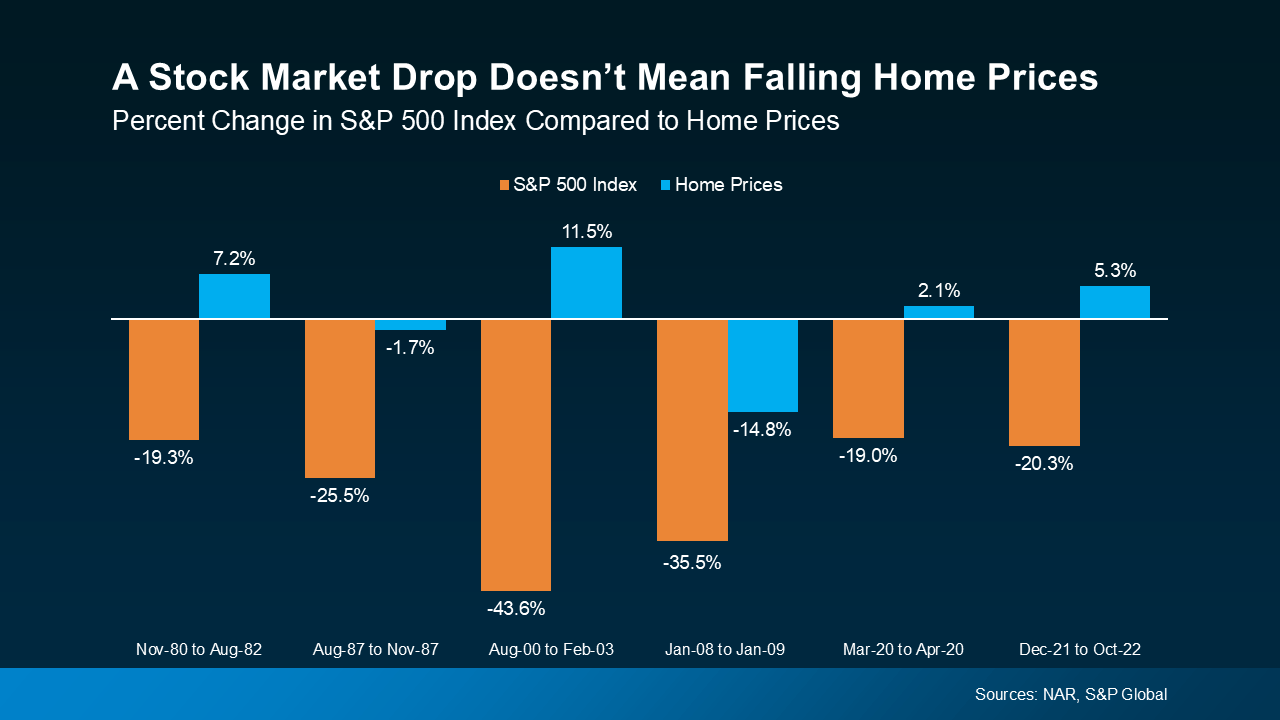

A Drop in the Stock Market Doesn’t Mean a Crash in Home Prices

Take a look at the graph below. It shows what happened to home prices (the blue bars) during past stock market swings (the orange bars):

Even when the stock market falls more substantially, home prices don’t always come down with it.

Even when the stock market falls more substantially, home prices don’t always come down with it.

Big home price drops like 2008 are the exception, not the rule. But everyone remembers that one. That stock market crash was caused by loose lending practices, subprime mortgages, and an oversupply of homes – a scenario that doesn’t exist today. That’s what made it so different.

In many cases before and after that time, home values actually went up while the stock market went down, showing that real estate is generally much more stable.

This graph shows how stock prices go up and down (the orange line), sometimes by more than 30% in a year. In contrast, home prices (the blue line) change more slowly (see graph below):

Basically, stock values jump around a lot more than home prices do. You can be way up one day and way down the next. Real estate, on the other hand, isn’t usually something that experiences such dramatic swings.

Basically, stock values jump around a lot more than home prices do. You can be way up one day and way down the next. Real estate, on the other hand, isn’t usually something that experiences such dramatic swings.

That’s why real estate can feel more stable and less risky than the stock market.

So, if you’re worried after the recent ups and downs in your stock portfolio, rest assured, your home isn’t likely to experience the same volatility.

And that’s why homeownership is generally viewed as a preferred long-term investment. Even if things feel uncertain right now, homeowners win in the long run.

Bottom Line

A lot of people are feeling nervous about their finances right now. But there’s one reason for you to feel more secure – your investment in something that’s stood the test of time: real estate.

Learn why investing in real estate provides stability and consistent growth, even when stock markets are experiencing volatility. Explore the benefits of homeownership as a solid, dependable asset.

home values, stock market volatility, real estate stability, investment stability, housing market trends, financial growth, property investment, homeownership benefits, stable assets, secure investments

Learn more:

Investors often grapple with the unpredictable nature of stock markets, leaving many to seek safer alternatives. One such option is real estate investments, which are renowned for providing stable, long-term returns, even during economic downturns. Home values tend to rise steadily over time, making real estate a secure investment strategy. Unlike stocks, which can fluctuate wildly based on market shifts, owning a home provides financial stability, predictable equity growth, and the opportunity to diversify your portfolio outside traditional markets. Historical data reveals consistent appreciation trends in the housing market. Additionally, homeownership brings personal benefits like tax advantages, creating a win-win scenario for buyers and investors. Those new to real estate investing may benefit from exploring first-time homebuyer resources to take the initial steps toward financial security in a volatile world.

Categories

Recent Posts