What a Fed Rate Cut Could Mean for Mortgage Rates

What a Fed Rate Cut Could Mean for Mortgage Rates

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But does that mean mortgage rates will drop? Let’s clear up the confusion.

The Fed Doesn’t Directly Set Mortgage Rates

Right now, all eyes are on the Fed. Most economists expect they'll cut the Federal Funds Rate at their mid-September meeting to try to head off a potential recession.

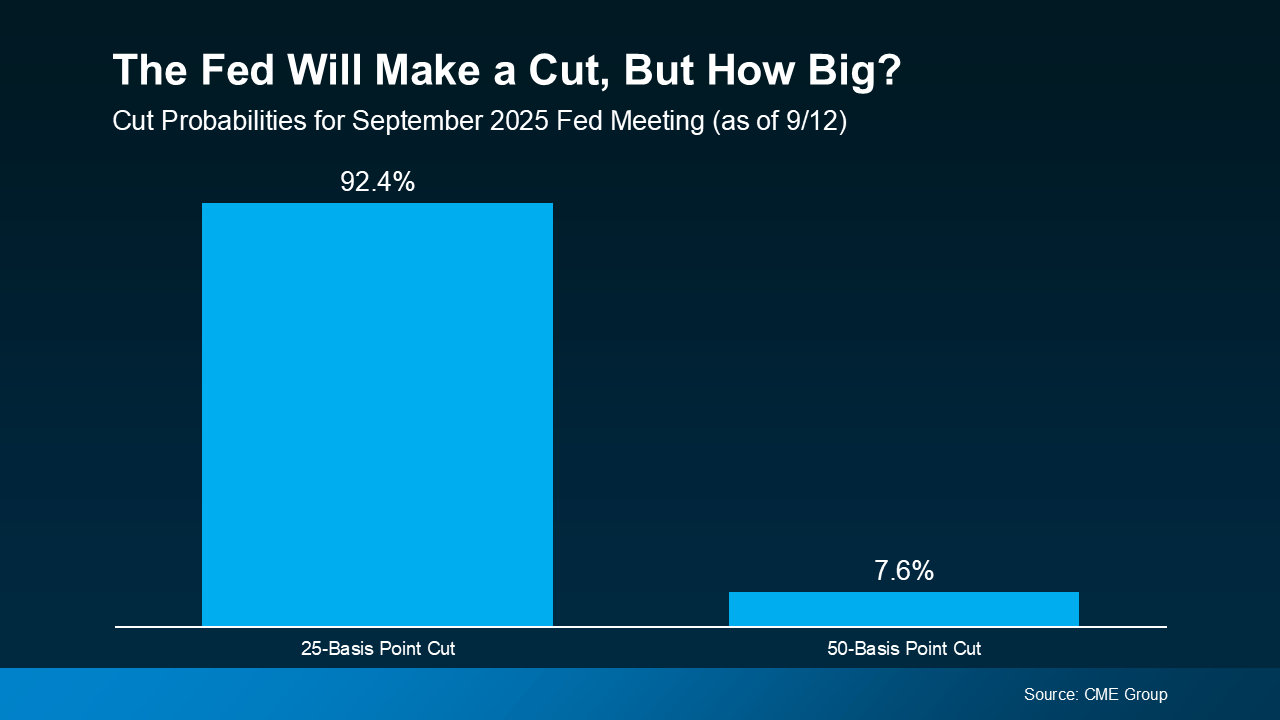

According to the CME FedWatch Tool, markets are already betting on it. There’s virtually a 100% chance of a September cut. And based on what we know now, there’s about a 92% chance it’ll be a small cut (25 basis points) and an 8% chance it will be a bigger cut (50 basis points):

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

So, what exactly is the Federal Funds Rate? It’s the short-term interest rate banks charge each other. It impacts borrowing costs across the economy, but it’s not the same thing as mortgage rates. Still, the Fed’s actions can shape the direction mortgage rates take next.

Why Markets Already Saw This Cut Coming

Here’s the part that may surprise you. Mortgage rates tend to respond to what the financial markets think the Fed will do, before the Fed officially acts. Basically, when markets anticipate a Fed cut, that outlook gets priced into mortgage rates ahead of time.

That’s exactly what happened after weaker-than-expected jobs reports on August 1 and September 5. Each time, mortgage rates ticked down as financial markets grew more confident a cut was coming soon. And even though inflation rose slightly in the latest CPI report, the Fed is still expected to make a cut.

So, if the Fed goes with a 25-basis point cut, as expected, that’s likely already baked in to current mortgage rates, and we may not see a dramatic drop.

But if they go bigger and drop their Federal Funds Rate by 50 basis points instead, mortgage rates could come down more than they already have.

So, Where Do Mortgage Rates Go from Here?

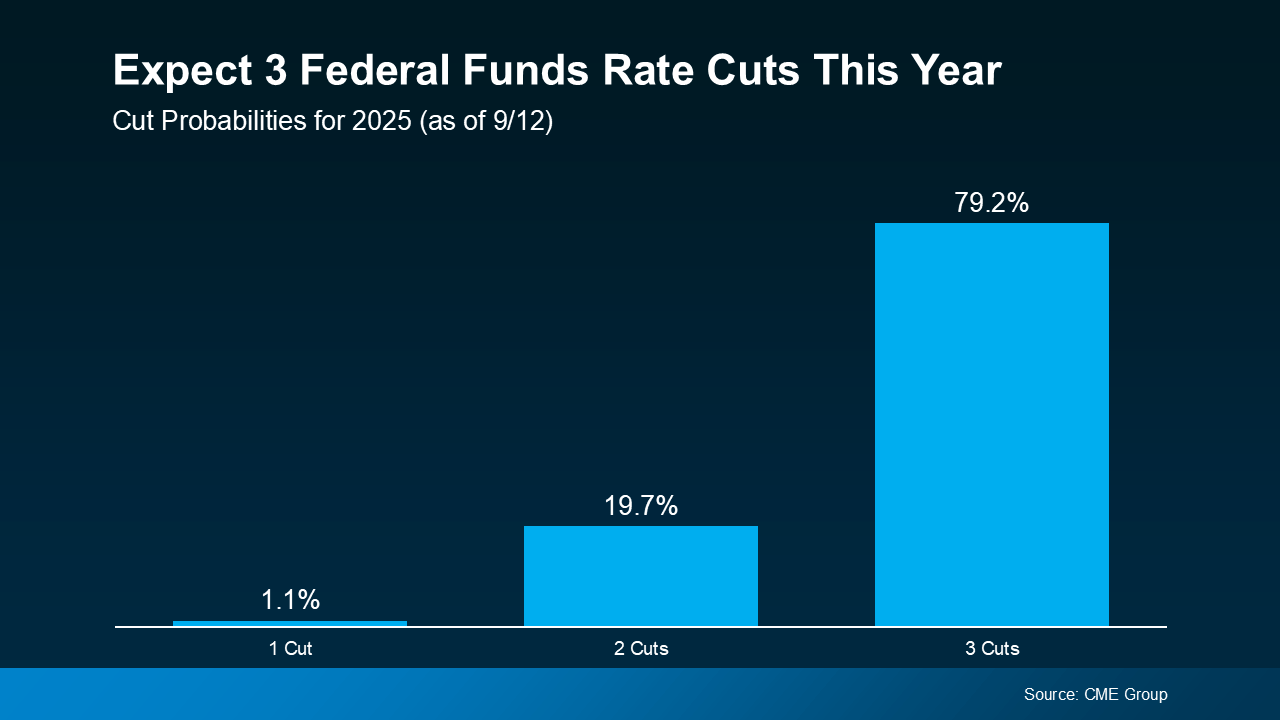

While the upcoming cut may not move the needle much, many experts expect the Fed could cut the Federal Funds Rate more than once before the end of the year. Of course, that’s if the economy continues to cool (see graph below):

As Sam Williamson, Senior Economist at First American, explains:

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

If multiple rate cuts happen, or even if markets just believe they will, mortgage rates could ease further in the months ahead. But here’s the catch – all of this depends on how the economy evolves. Surprise inflation data or unexpected shifts could quickly change the outlook.

Discover how a Fed rate cut could affect mortgage rates. Understand the impact on home buying and financial trends to make informed decisions. Learn more.

- Fed rate cut mortgage rates

- Mortgage rates

- Federal Reserve

- How does Fed rate affect mortgage

- Fed interest rate

- Home loan rates

- Housing market trends

- Buying a house

- What a Fed rate cut means

- Will mortgage rates go down

- Current mortgage interest rates

- Economic impact of interest rate cuts

- Refinance mortgage rates

- Fed meeting today

- Impact of inflation on mortgage rates

- Predicting mortgage rate trends

- Best time to buy a house

- Financial news for homeowners

To fully grasp the connection between a Fed rate cut and your potential home loan, it's helpful to explore various expert resources. The Federal Reserve provides official announcements that directly influence financial trends. Understanding these announcements is key to predicting changes in mortgage rates. For those planning on home buying, tracking these shifts can make a significant difference. You can find detailed analyses on the broader economic impacts of such decisions from major financial news outlets. Many consumers also turn to mortgage-specific platforms for advice on when to lock in a rate. Further insights into how the Federal Reserve's policies affect the housing market can provide a more complete picture. For a deeper dive, consider resources that explain the relationship between the federal funds rate and consumer loan percentages. Finally, staying informed about overall market predictions can help you navigate the complexities of securing a mortgage in a changing economic landscape. Reviewing historical data on rate adjustments offers valuable context for future decisions.

Bottom Line

Mortgage rates likely won’t drop sharply overnight, and they won’t mirror the Fed’s moves one-for-one. But if the Fed begins a rate-cutting cycle, and markets continue to expect it, mortgage rates could trend lower later this year and into 2026.

If you’ve been waiting and watching the housing market, now’s the time to talk strategy. Even small changes in rates can make a meaningful difference in affordability, and understanding what’s ahead helps you make the best decision for your situation.

Categories

Recent Posts