You Could Use Some of Your Equity To Give Your Children the Gift of Home

You Could Use Some of Your Equity To Give Your Children the Gift of Home

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life.

Since affordability is still a challenge, a lot of first-time buyers are struggling to buy a home in today’s market. Even if they have a stable job and a solid plan, buying can still feel out of reach. But that’s where your equity could make all the difference.

To give you an idea, the average homeowner with a mortgage has $311,000 worth of equity, according to Cotality (formerly CoreLogic). That’s significant. And some parents are using a portion of their equity to help their children become homeowners, too.

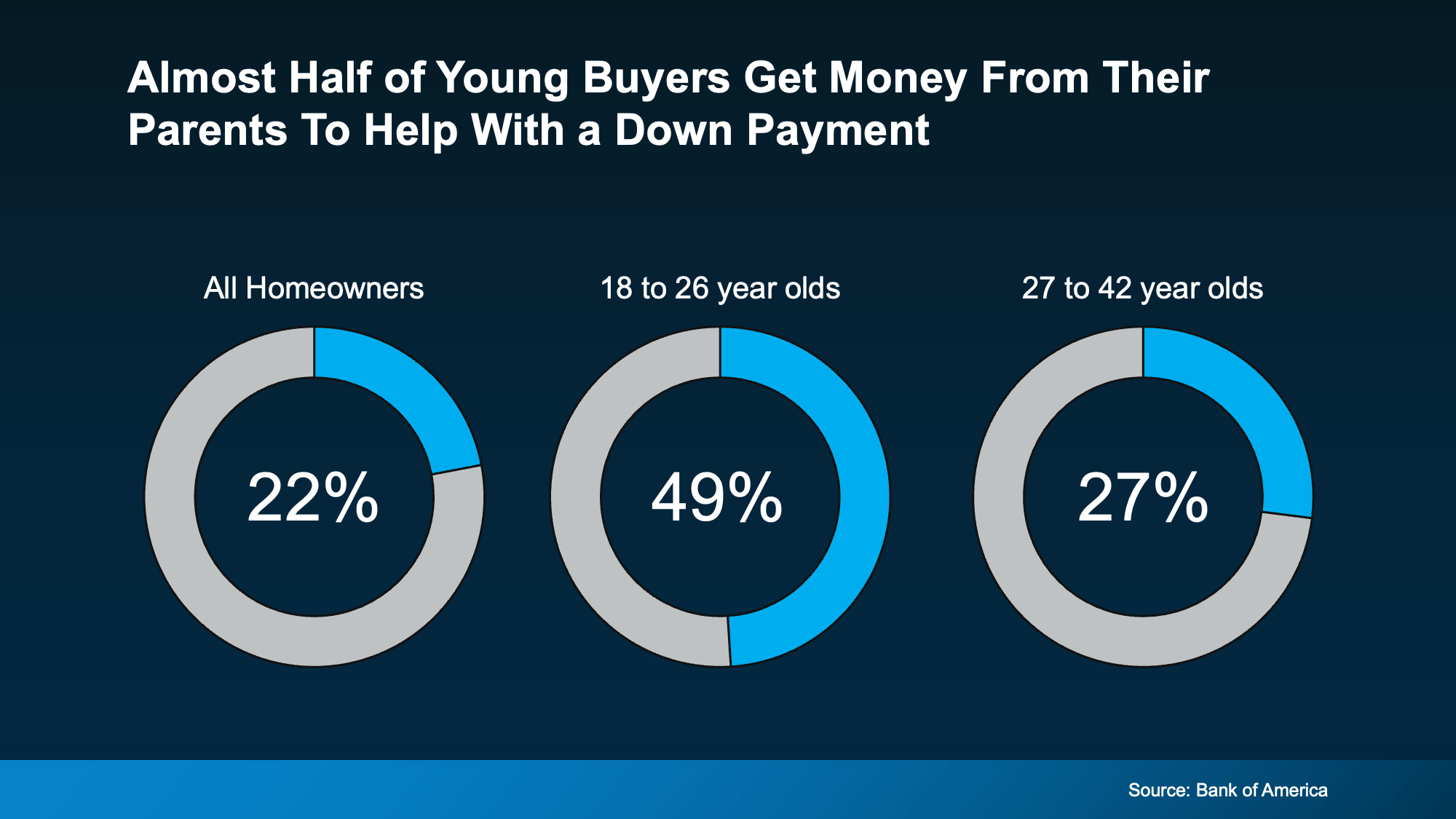

According to Bank of America, 49% of buyers between 18 and 26 got money from their parents to use toward their down payment (see chart below):

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

While what’s right for each person’s specific situation will vary on a case-by-case basis, that’s a powerful legacy to pass on. It helps those younger people buy a home, build equity of their own, and begin the next chapter of their life with a little less financial stress and a lot more stability. And for those parents? It’s a way to turn what they've built into something deeply meaningful.

This isn’t just about money. For many homeowners, it’s about being the reason their child gets to say, “we got the house.” And giving them the kind of head start they might’ve only dreamed of at their age. And here’s the part that really sticks. Compare the Market says:

“Of those who did receive monetary aid from parents and grandparents to buy a house, 45% of Americans said they would not have been able to purchase a house without financial support from parents and grandparents.”

Learn how you can use your home equity to help your children achieve the dream of homeownership. Discover practical insights and step-by-step guidance for leveraging equity to pave the way for their financial independence.

use home equity, gift of homeownership, help your children buy a home, leveraging home equity, financial independence for children, home equity benefits, support children's home purchase, build generational wealth, equity for family, real estate financial planning

Learn More:

Home equity is a powerful tool that can help you support your children in purchasing their dream home. By leveraging your equity, you can offer financial assistance that fosters generational wealth and provides them a solid foundation. Understanding strategies like home equity loans or HELOCs, you’ll be better equipped to help your children achieve homeownership. This act not only builds their financial independence but also strengthens family bonds. Choosing the right time to tap into your home equity ensures you maximize your resources while being financially secure. Be sure to explore tools like mortgage calculators to plan effectively. Remember to consider implications such as tax benefits and stay aligned with your family's long-term goals for a secure and happy future.

Bottom Line

Your equity could be the thing that makes homeownership possible for your children when they might not be able to do it on their own. So, here’s the question.

If helping your kids buy a home was more feasible than you thought, would you want to explore that option?

If you want to learn more or find out the best way to make it happen, talk to your lender and a financial advisor you trust.

Categories

Recent Posts