Are You Saving Up To Buy a Home? Your Tax Refund Can Help

Are You Saving Up To Buy a Home? Your Tax Refund Can Help

You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So, if you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home, like the down payment and closing costs. And here’s the best part.

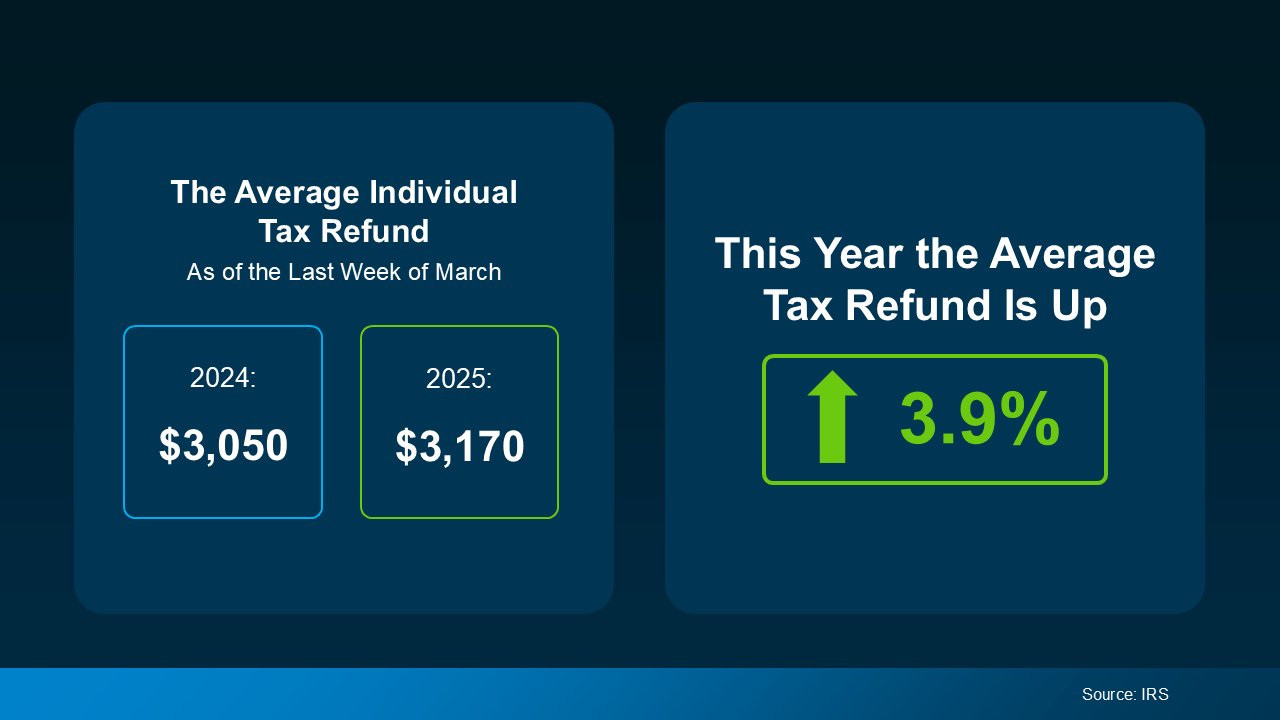

On average, people are getting even more money back in their refunds than they did last year. While it’s not a big increase, the visual below uses data from the Internal Revenue Service (IRS) to show the average individual’s refund is 3.9% higher this year:

Of course, how much money you may get in your tax refund is going to vary. But when it comes to buying a home, any extra cash can help move things forward. Here are a few examples of how you can put that money to good use, according to Freddie Mac:

- Save for a down payment – Saving for a down payment can be one of the biggest hurdles for buyers. Setting aside your tax refund for this expense could help you get to your goal faster. Just remember, it’s typically not required to put 20% down.

- Pay for closing costs – Closing costs include fees for things like the appraisal, title insurance, and underwriting of your loan. They’re generally between 2% and 5% of the total purchase price of the home. So, putting your refund toward these costs can make things more manageable on closing day.

- Lower your mortgage rate – Your lender might give you the option to buy down your mortgage rate. If you qualify for this option, you could pay up front to have a lower rate on your mortgage. If affordability is tight for you at today’s rates and home prices, this may be worth exploring.

But you don’t have to figure it all out on your own. Working with a team of trusted real estate professionals who understand the homebuying process, what you need to save, and any resources you can tap into will help you make sure you’re ready to buy when the time comes.

Learn how to make the most of your tax refund and use it as a stepping stone toward homeownership. Discover tips, strategies, and resources for saving up to buy your dream home.

tax refund, buy a home, homeownership, saving for a house, financial planning, home loan, first-time buyers, down payment, build credit, tax season tips.

Learn more:

If you’re saving up to buy a home, your tax refund could be a valuable resource for building your dream. Consider using it to boost your down payment savings, covering closing costs, or even paying off debt to improve your credit score. First-time buyers, don’t miss out on assistance programs and tax credits, which can help you get started. For more strategies, explore budgeting tips, learn about mortgage options, and check out home affordability calculators. Stay prepared by reviewing this first-time homebuyer guide and developing a solid savings plan. Planning well today can bring you closer to holding the keys to your future home.

Bottom Line

When it comes to saving for a home, every dollar gets you one step closer to your goal. While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost.

What would having your own home mean for you or your family this year? Let’s talk about it and we’ll come up with a strategy for success.

Categories

Recent Posts