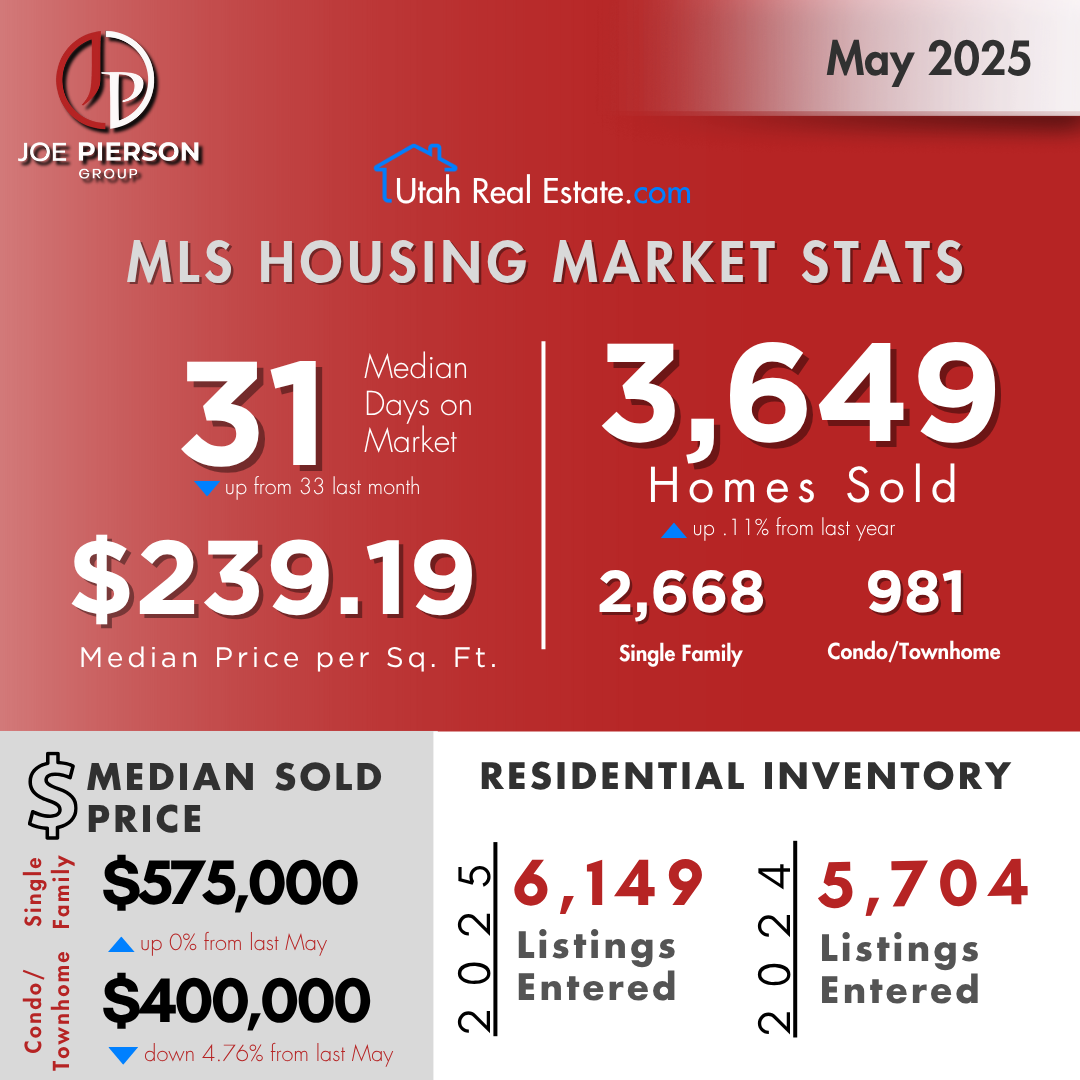

May 2025 Market Overview

📊 May 2025 Market Overview

🏠 Sales Activity

- 3,649 homes sold in May 2025 — a 1.1% increase from May 2024.

- 2,668 single-family homes

- 981 condos/townhomes

- This marks a positive year-over-year trend, showing stable or slightly increased buyer demand.

⏳ Median Days on Market

- 31 days, down from 33 days last month.

- Homes are selling faster, reflecting a competitive market environment.

💲 Pricing Trends

- Median price per sq. ft.: $239.19 (up slightly from April)

- Single-family home median price: $575,000

- (no change from May 2024)

- Condo/townhome median price: $400,000

- (down 4.76% from last year)

- Indicates some softening in the condo/townhome segment.

📦 Residential Inventory

- 6,149 new listings in May 2025

- Up from 5,704 listings in May 2024

- A 7.8% increase in inventory, offering more choices to buyers and contributing to a more balanced market.

🔍 What This Means

- For Buyers:

- You have more listings to choose from and homes are moving quickly—be prepared to act fast, especially on well-priced properties.

- For Sellers:

- Prices are stable for single-family homes, but competition is increasing. Strategic pricing and presentation are essential, particularly for condos.

- For Investors:

- The dip in condo prices may create value opportunities, especially if rental demand remains strong.

📝 Bottom Line

The May 2025 housing market shows strong sales, stable pricing for single-family homes, and growing inventory. While condos are seeing a price dip, overall activity is healthy and continues to trend upward.

Categories

Recent Posts

Builder Incentives Reach 5-Year High

What Mortgage Delinquencies Tell Us About the Future of Foreclosures

Thinking About Renting Your House Instead of Selling? Read This First.

What Everyone’s Getting Wrong About the Rise in New Home Inventory

History Shows the Housing Market Always Recovers

Should You Still Expect a Bidding War?

From Frenzy to Breathing Room: Buyers Finally Have Time Again

Condos Could Be a Win for Today’s Buyers

More Contracts Are Falling Through. Here’s How To Get Ahead.

Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff