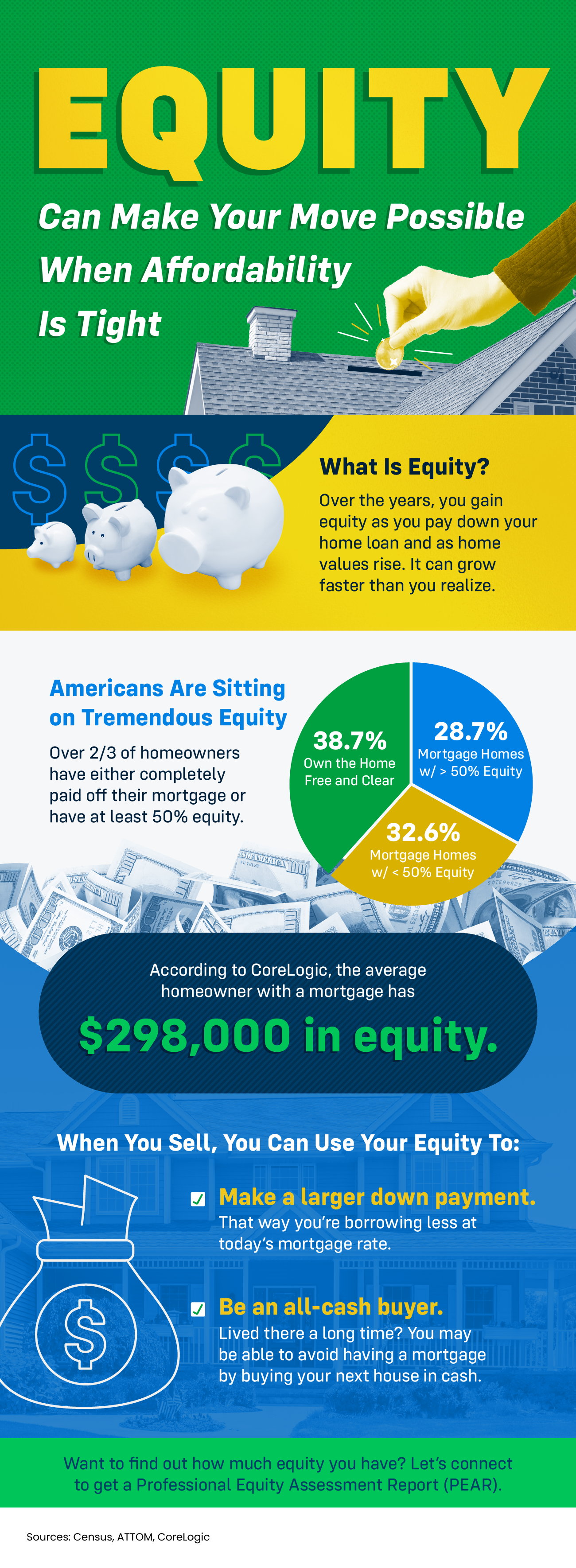

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, let’s connect for a Professional Equity Assessment Report.

Uncover how equity can be your ally in making a move when affordability seems out of reach. Learn strategies for leveraging home equity to transition into your next dwelling, even in a tight housing market.

Learn more:

- `Understanding Home Equity and Its Benefits`

- `How to Use Your Home Equity for Moving`

- `Navigating a Tight Housing Market with Equity`

SEO Keywords:

- Home equity

- Moving when affordability is tight

- Leveraging equity for moving

- Equity and housing market

- Strategies for using home equity

Categories

Recent Posts

Mortgage Rates Just Saw Their Biggest Drop in a Year

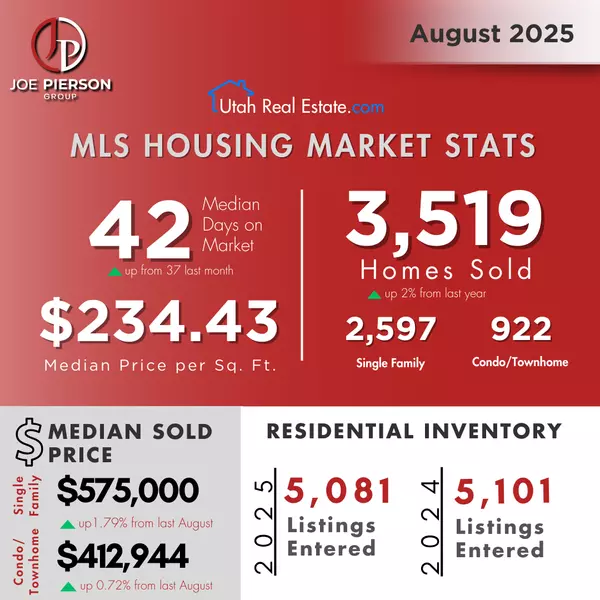

August 2025 Market Overview

September Activities in Salt Lake, Utah

Why 50% of Homes Are Selling for Under Asking and How To Avoid It

Builder Incentives Reach 5-Year High

What Mortgage Delinquencies Tell Us About the Future of Foreclosures

Thinking About Renting Your House Instead of Selling? Read This First.

What Everyone’s Getting Wrong About the Rise in New Home Inventory

History Shows the Housing Market Always Recovers

Should You Still Expect a Bidding War?